17 Banking Form Templates that Automate Workflows

Running a bank or a financial institution means constantly finding a balance between complying with endless regulations and being customer-centric. And it’s possible with the right tools. For example, many processes can be automated with online banking forms. You can keep your data collection safe and secure while offering your customer a great digital experience.

Let us show you what we mean and how you can use banking forms to streamline your workflows. Here are our top 17 banking form templates:

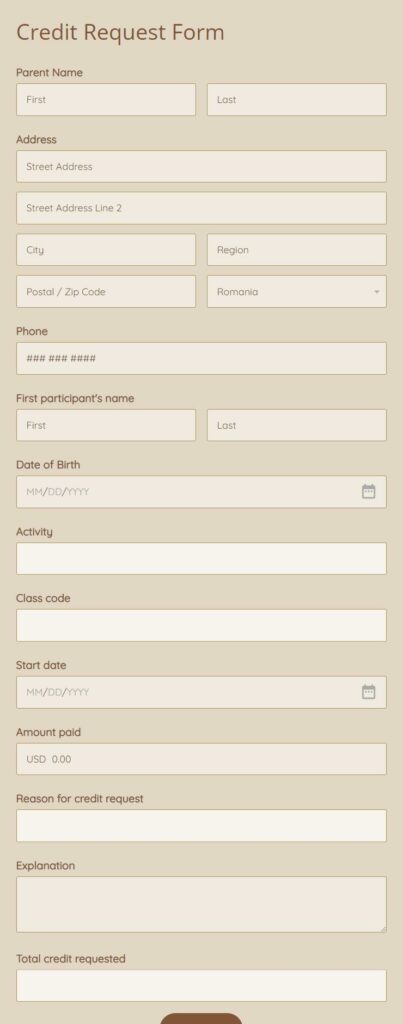

1. Credit Request Form Template

Who needs this?

The credit request form template is helpful to businesses, banks, or individuals that manage credit inquiries.

What’s it for?

Use the form to collect data about the applicants and keep track of all the solicitations. You can ask for any type of personal or financial data that could help you process the request.

Key benefits

With this credit request form template, you get an easy way to create your version by customizing it with our intuitive drag and drop form builder. Add, remove, or rearrange any element, including changing colors and fonts, and make it on-brand. Set up email notifications for every submission that comes in and share the form with your organization and your customers online: website, Social Media, email, or Whatsapp.

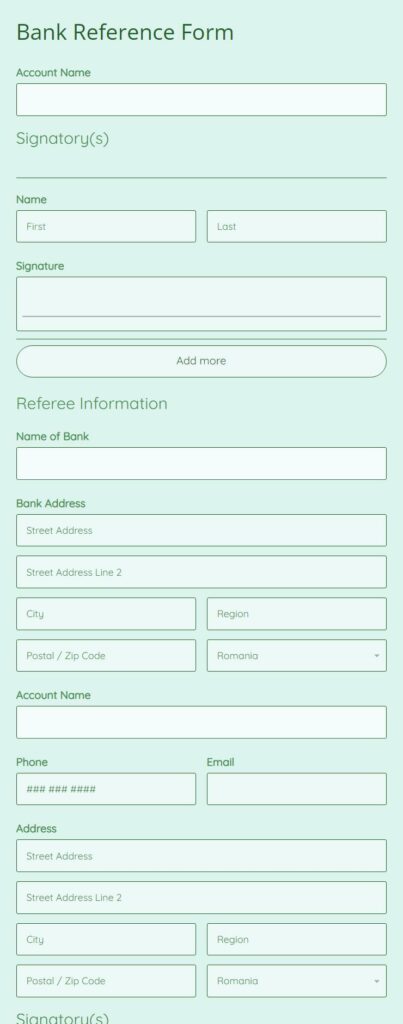

2. Bank Reference Form Template

Who needs this?

If you’re representing a bank or other financial institution, you can use the bank reference form template to collect referee information from applicants in a prompt manner.

What’s it for?

Banks usually use this form template to give their customers a simple way to ask for a bank reference letter. By just filling out a couple of fields, clients can easily submit their request while your bank staff can quickly process it and save time.

Key benefits

The bank reference form template comes in handy for banks that want to reduce human error, improve staff productivity, and streamline their work processes. No coding skills? No problem. We’re all about drag & drop here! Use this template to create a copy of your own and customize it with your requirements. Include a digital signature, connect it to your other tools such as Dropbox or Mailchimp, and embed it on your website or share it through a link.

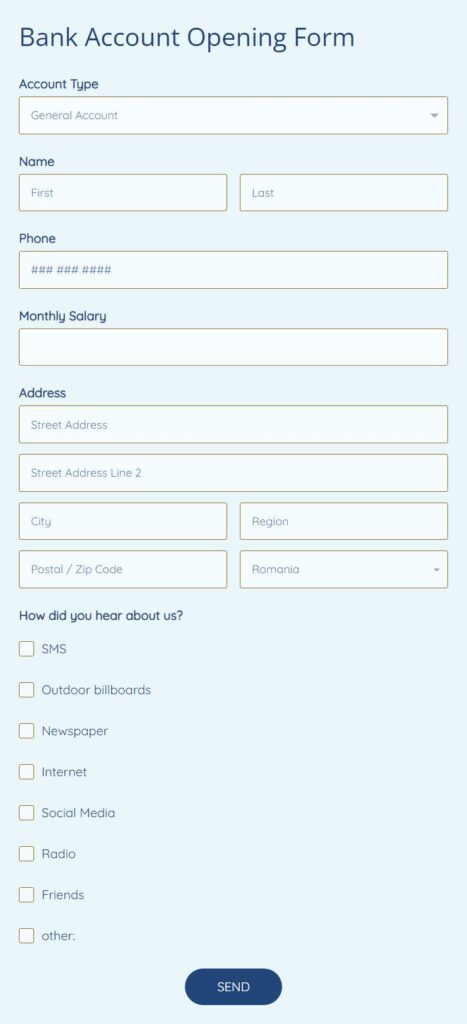

3. Bank Account Opening Form Template

Who needs this?

Banks, credit unions, or other financial institutions can use the bank account opening form template to accept bank account application requests from customers.

What’s it for?

Use it to collect data about customers seeking to open a bank account at your institution. Help them avoid a visit to your bank and give them the chance to submit their request online.

Key benefits

The bank account opening form template helps you automate your workflows and simplify how you accept your customers’ applications. Grab this template and customize it with our drag and drop feature. You don’t need any coding skills, and we make it easy for you to edit all the fields and design elements. Use conditional logic to expand or hide fields and create an interactive experience for your customers. Share the form by including it on your website or email.

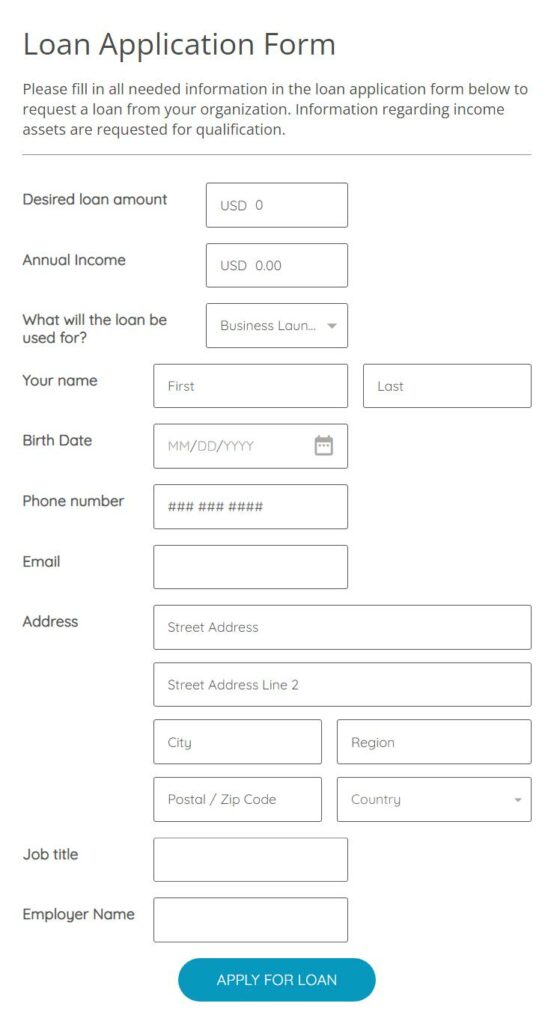

4. Loan Application Form Template

Who needs this?

Any financial institution could benefit from this loan application form to accept and process loan requests more efficiently.

What’s it for?

The loan application form template helps banks collect data about the applicants to decide whether they qualify for a loan. You can ask for personal and financial information and use it to perform a background check.

Key benefits

If you’re looking for a loan application form template that you can start using in less than five minutes, this is the one. Grab your copy, adjust it to your needs, and publish it on your website for potential applicants to fill in. Connect it to third-party applications like Salesforce or Dropbox, and create a seamless workflow that saves you time, collects accurate data, and keeps it safe.

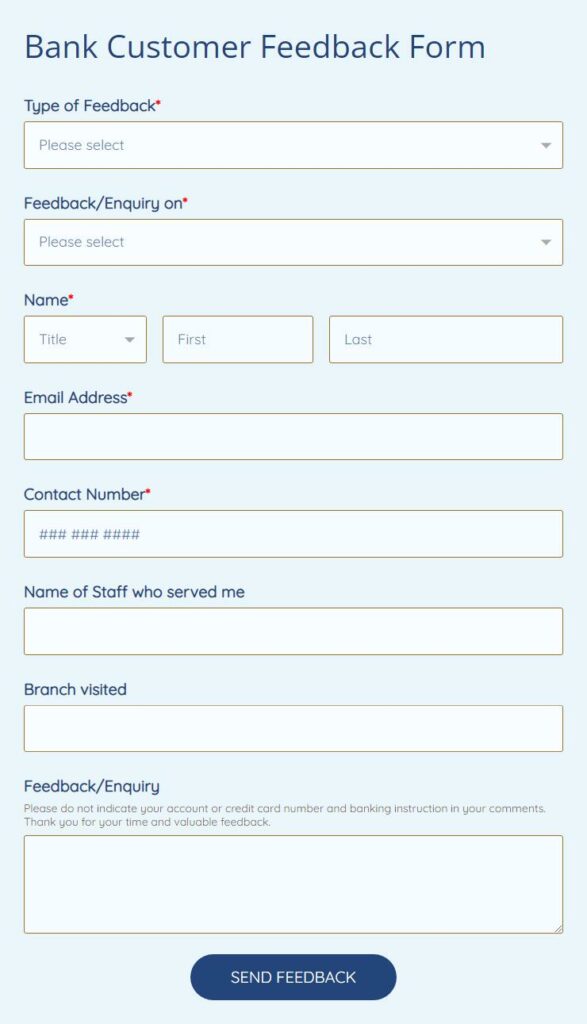

5. Bank Customer Feedback Form Template

Who needs this?

Banks and financial institutions can use this bank customer feedback form to gather insights from their clients on the quality of their services and the overall customer experience.

What’s it for?

If you’re interested in learning more about how your customers perceive your services and if they’re satisfied with their experience at your bank, use the customer feedback form to collect their opinions.

Key benefits

The bank customer feedback form template gives you a great way to pick your customers’ brains and understand how they feel about your bank and your customer service. Take this template and customize it with questions that are relevant to your business. Be as specific as you need by using conditional logic. There are no coding skills necessary. Our drag and drop feature makes it easy to move elements around. Design and share the form with your customers and start collecting customer feedback in just a few minutes!

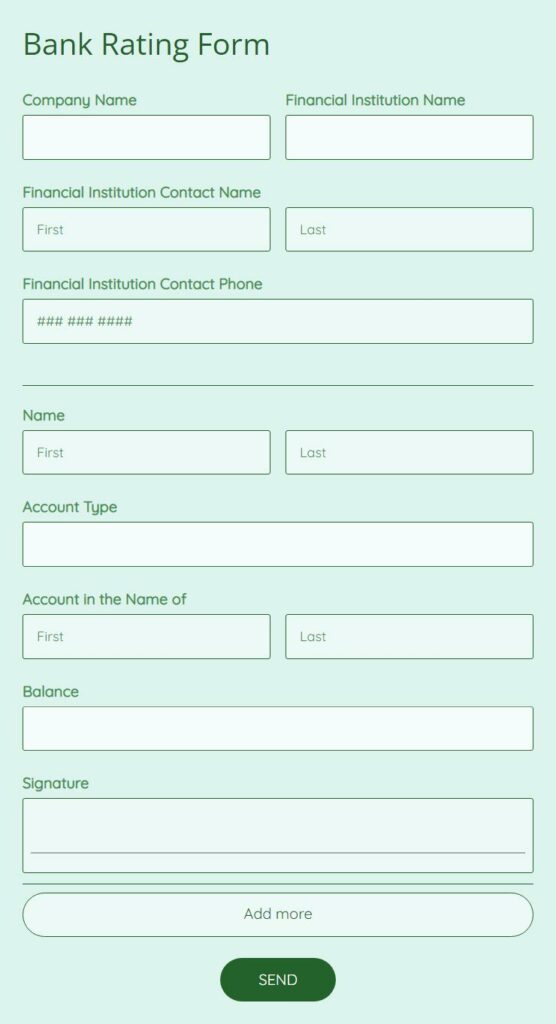

6. Bank Rating Form Template

Who needs this?

Banks or regulatory agencies use the bank rating form template to receive evaluations or assess an institution’s financial health.

What’s it for?

Institutions such as the Federal Deposit Insurance Corporation (FDIC) or credit rating agencies use these forms to rate a bank’s financial health and quality of services.

Key benefits

The bank rating form template can help financial institutions assess a company’s financial stability accurately. Use this template to personalize your criteria relevant to your case. You don’t need any coding skills; our form builder is intuitive and easy to use. You can connect the form to your other third-party tools to help the data smoothly travel across apps. Simplify the evaluation process and collect data securely and efficiently.

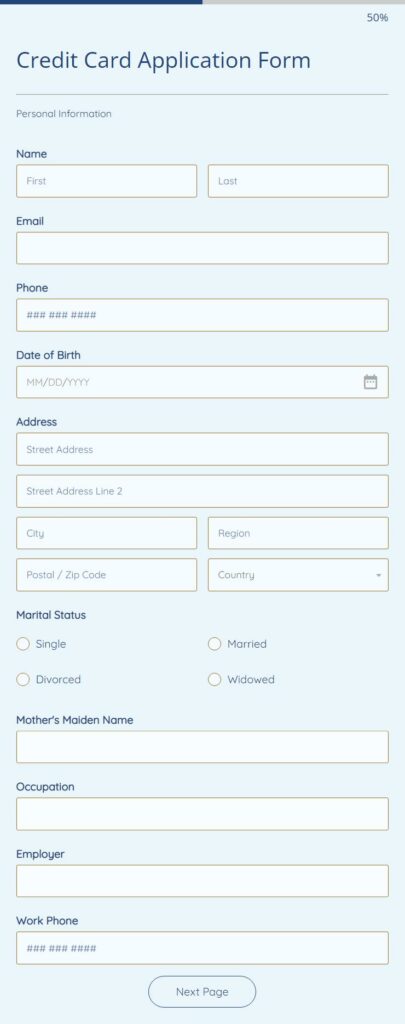

7. Credit Card Application Form Template

Who needs this?

Any bank or financial institution can use the credit card application form to receive and process customer requests.

What’s it for?

The credit card application form template helps collect data about the customer requesting a credit card. Whether it’s personal information, contact details, or financial data, the form gives both you and your client an efficient way to communicate.

Key benefits

By digitalizing your workflows, you get to save a lot of time for your staff and offer your customers a great experience. Our credit card application form template is easy to edit and design. The drag and drop feature helps you explore endless possibilities without any programming involved. You can connect the form to apps such as Salesforce or Google Drive so you can automate processes and keep your data safe and secure. Activate email notifications whenever a submission comes in and become even more responsive to customer requests.

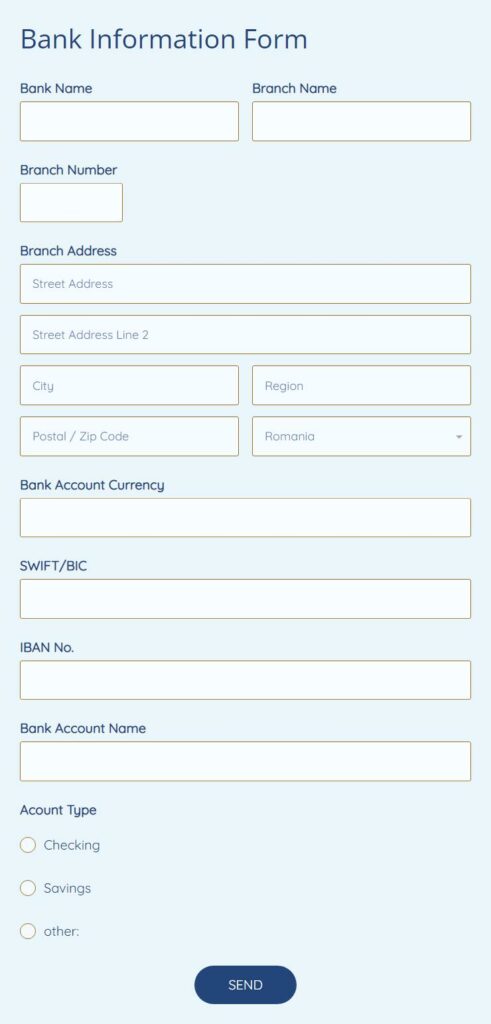

8. Bank Information Form Template

Who needs this?

Any type of organization can use the bank information form to collect bank details from their customers or employees.

What’s it for?

When you want to document an individual’s banking information, be it for payment, loan, or just as a legal requirement, you can use the bank information form to collect and process this data.

Key benefits

People don’t readily share their banking information, so you want to give them a secure and trustworthy way to do that. The bank information form helps you quickly and safely collect bank details from your customers or employees. Build your copy by using our template and customizing it with your branding details. Save your customers a trip and share it digitally with them either by email or a messaging app. Send confirmation emails and create a customer experience while becoming more efficient.

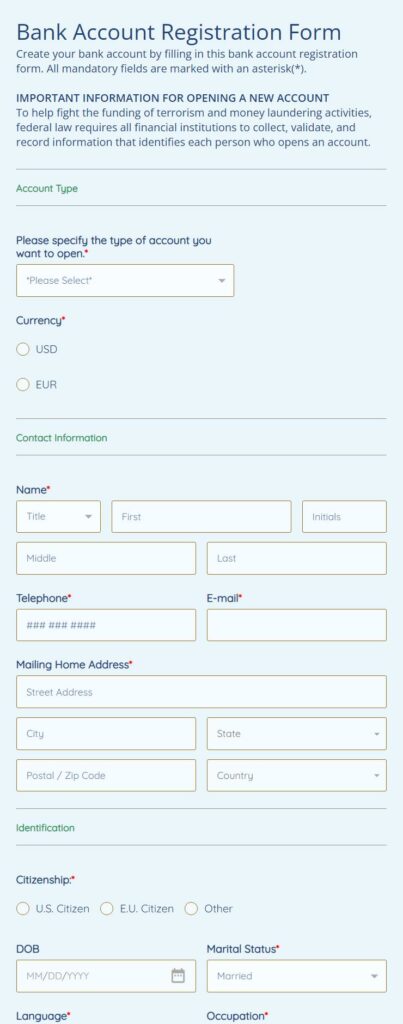

9. Bank Account Registration Form Template

Who needs this?

Banks worldwide can use this bank account registration form to accept applications from customers seeking to open a bank account.

What’s it for?

The bank account registration form helps banks simplify the way customers request opening a new bank account. There’s no need for an appointment. Customers can quickly fill out this form online with their personal and financial details and submit their inquiries, while banks effortlessly collect this data and process the application.

Key benefits

Cutting queues is something that both banks and customers can benefit from. By digitizing this internal workflow, banks will speed up their operations and increase customer satisfaction by saving them time. Grab a copy of our bank account registration form template and edit it with your fields and branding elements using our drag and drop tool. Add, remove, or rearrange fields. Include digital signatures and safely collect all the details you need to process requests efficiently and boost your overall productivity.

10. Customer Feedback Form Template

Who needs this?

The customer feedback form template is helpful to any bank or financial institution that looks to become more customer-centric by researching their clients’ needs and expectations.

What’s it for?

You can gather valuable feedback from your customers about their experience and if you live up to their expectations. Whether you use open-ended questions or a rating system, you can collect quantitative or qualitative data that can help you better understand your customers’ assessment.

Key benefits

One proven way to improve your products and services is to ask your customers what they think about your current offering. Dropping a question at the end of a face-to-face interaction might not prove to be very efficient or accurate. So, use this customer feedback form template to build a survey that can actually get you honest feedback and makes it easy for your customers to share it with you. Customize our copy to fit your evaluation criteria and include design elements such as your logo. Collect feedback systematically so you can process it and draw helpful insights from it. Integrate the form with your other favorite tools such as Mailchimp, Salesforce, or Google Drive. And make the data available for your team members with just a few clicks!

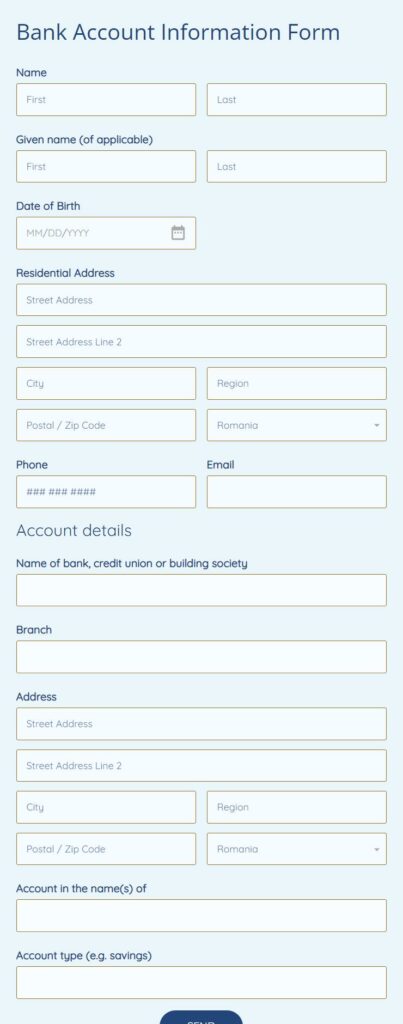

11. Bank Account Information Form Template

Who needs this?

Any organization that needs to gather an individual’s bank account details can use the bank account information form.

What’s it for?

This form gives your company an efficient way to collect bank account information and keep a straight record of all the data.

Key benefits

Most processes that deal with customers’ banking information can be automated with the right tools. Our bank account information form template helps banks simplify their data collection processes by enabling them to perform these operations digitally instead of the old-fashioned paper forms. Clone this template and modify it with your requirements. And after you’ve supercharged it with your branding elements, share it with your customers through email or messaging apps. Activate notifications for every submission, so you never miss any entry.

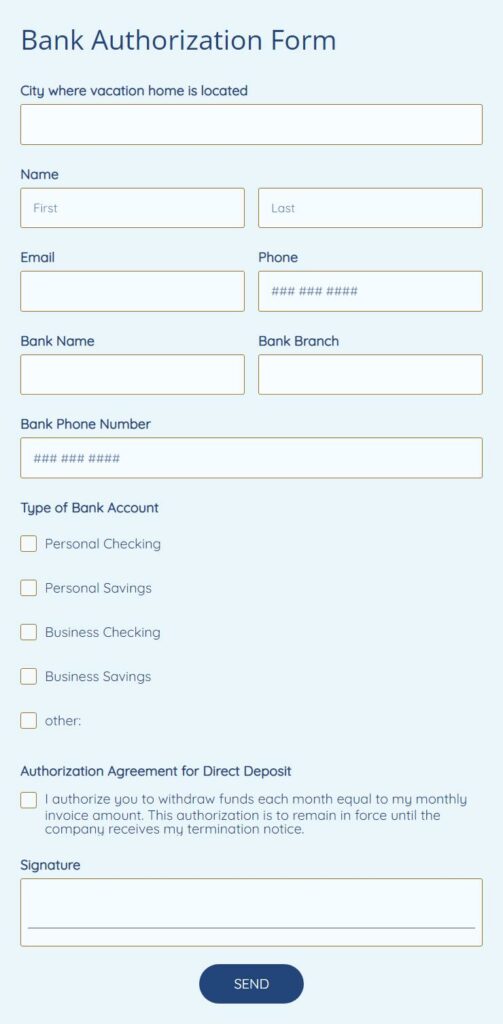

12. Bank Authorization Form Template

Who needs this?

Any financial institution can use the bank authorization form to let their customers approve withdrawals from their bank accounts.

What’s it for?

Any financial transaction that a customer makes needs bank authorization. Whether they withdraw money from the account or make a deposit, the bank will require approval.

Key benefits

The bank authorization form simplifies the approval process and makes payments easy and safe. They help banks automate this workflow and keep things simple for their customers. Our template allows a good deal of customization options so your customers can quickly recognize your brand and trust sharing their data. You don’t need any coding skills to edit and design your copy with 123FormBuilder, just our drag and drop editor and a couple of minutes to spare.

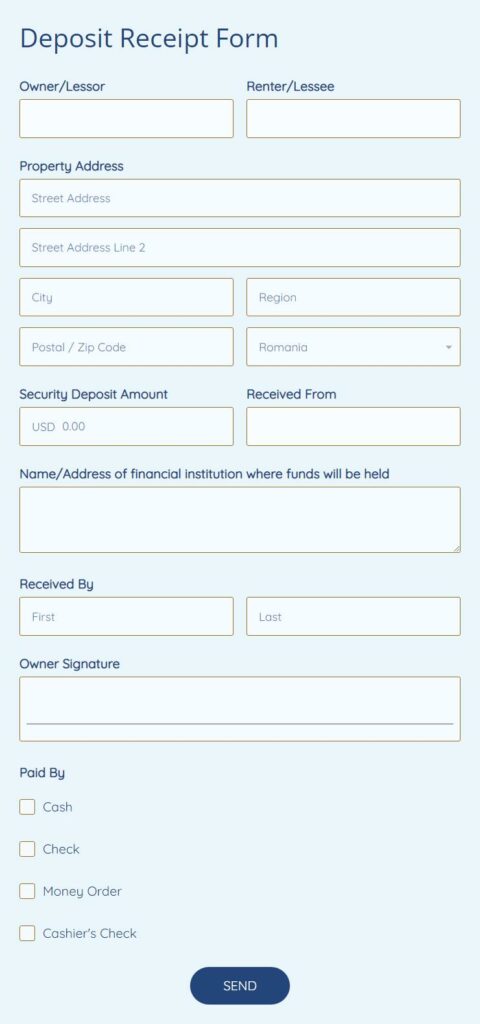

13. Deposit Receipt Form Template

Who needs this?

Banks usually use this deposit receipt form to record a deposit made by a customer, and it serves as proof for that transaction. But it can also be used by landlords when they accept a deposit from their tenants before renting a property.

What’s it for?

When a customer makes a cash deposit, for example, the bank issues a deposit receipt to the customer, documenting the transaction in this way. The same applies to the renting scenario. The deposit receipt usually covers information such as the details of both parties, the deposit amount, deposit type (cash, check, etc.). and digital signatures.

Key benefits

One of the main benefits of the deposit receipt form templates is that it keeps all the data and transactions online. And it saves you a lot of time by automating a process that otherwise would take a lot of time for planning and face-to-face meetings. This template is easy to customize: just take a copy and adapt it to your data collection needs. Then, with a simple copy-paste, you can share it with your customers on your website or by email.

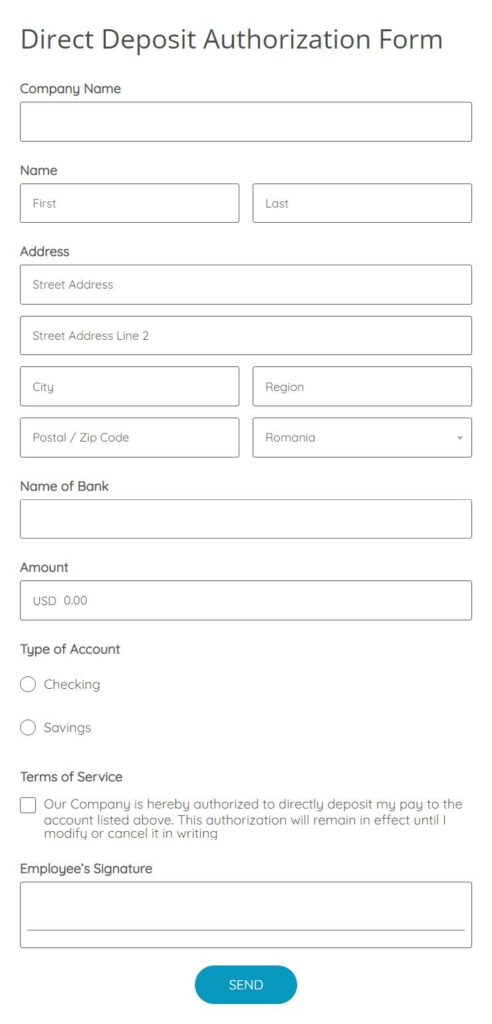

14. Direct Deposit Authorization Form Template

Who needs this?

Any organization that wants to deposit an amount of money in somebody’s bank account will find a direct deposit authorization form helpful and use it to obtain consent for that financial transaction.

What’s it for?

For example, when an employer or a company wants to send money (e.g., paycheck) to an individual’s account, they might need a direct deposit authorization. The form will ensure you collect all the essential information about the deposit, such as the company’s name, the contact details of the person receiving the money, the bank’s name, amount, terms and conditions, and possibly the digital signature.

Key benefits

This pre-made direct deposit authorization form template can come in quite handy if you want to cut the manual work and automate this operation. Our 123FormBuilder editor allows you to make a copy of the template and customize it from top to bottom, from adapting the layout and style to including conditional logic and setting up email notifications for every submission. You can ensure that all parties get a copy of the authorization. In addition, you have an accurate data collection process that reduces human error and makes your team more efficient.

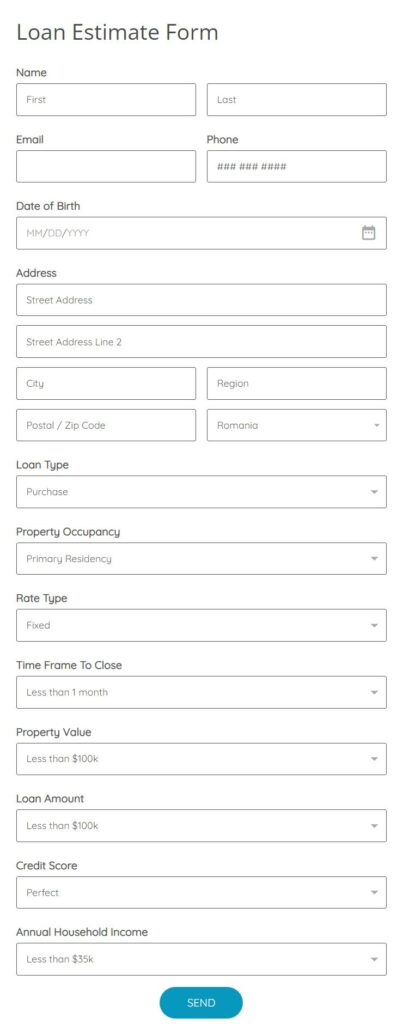

15. Loan Estimate Form Template

Who needs this?

If your bank or financial institution offers loans, this loan estimate form template can help you reduce your workload and provide more accurate estimations.

What’s it for?

The loan estimate form gives your customers an easy way to apply for a loan by sharing critical information that can, in turn, help you process their loan request faster and offer a detailed estimate with personalized terms.

Key benefits

You want to make sure you have all the data before giving your customers a loan estimate. With paper forms, information gets lost or misunderstood. Use the loan estimate form template to avoid a back and forth process and create a more efficient workflow. Make quick changes to it without any coding or special design skills. Our drag and drop editor is user-friendly, and you can see the changes as you make them. Connect the form to Google Sheets or Salesforce and create a smooth flow between your apps. Make the form available on your website and create a customer-centric experience aligned with your customer’s digital habits.

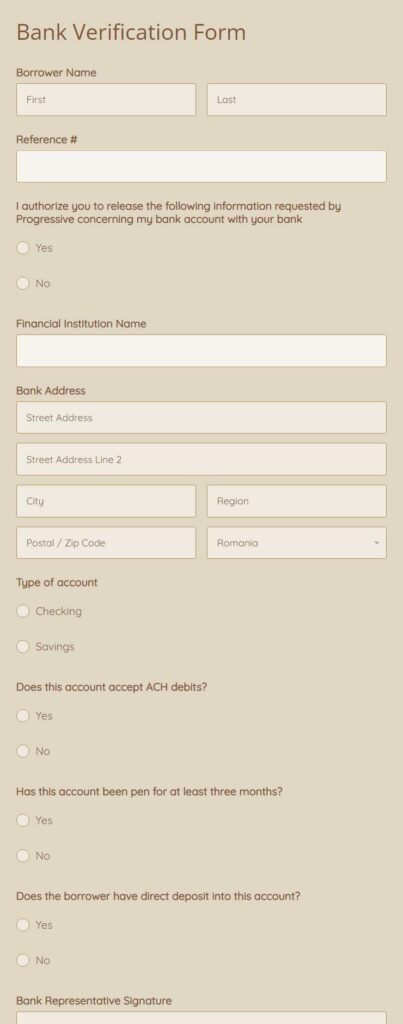

16. Bank Verification Form Template

Who needs this?

Financial institutions and banks use this bank verification form to check customers’ accounts and ensure their transactions are safe and sound.

What’s it for?

The bank verification form is one accurate and efficient way to verify an account’s details (name, type, balance, transactions), update it if necessary, and keep a straight record of all this data.

Key benefits

The verification form template is easy to modify and add your touch, from moving fields around and updating colors to including a digital signature. It allows you to export all the data into an Excel or CSV, and you can set up notifications that let you know when there’s a new entry. And the best part? You don’t need any coding skills to customize or share it with your clients.

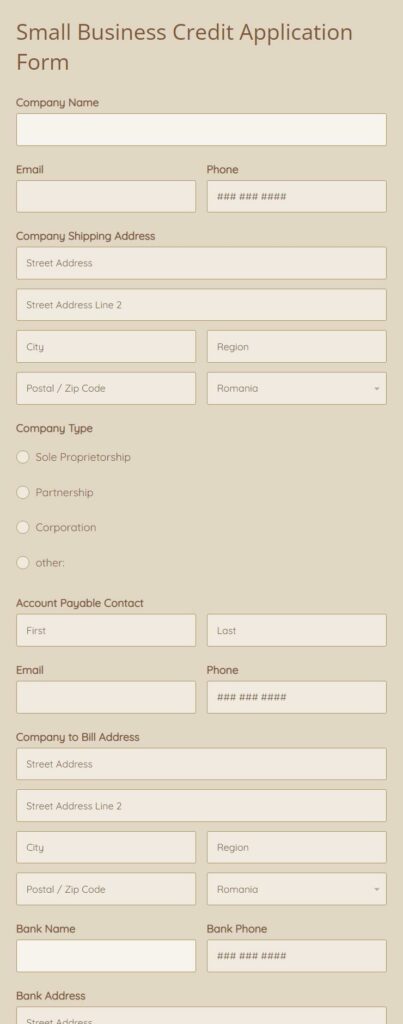

17. Small Business Credit Application Form Template

Who needs this?

If you’re offering a line of credit for small businesses, then this small business credit application form can significantly help you and your customers.

What’s it for?

Whenever a small business wants to apply for credit, you can share this small business credit application form with them. They can fill it out with their business details and their request while you quickly process the application and decide whether they qualify for one.

Key benefits

Our small business credit application form template has been designed to give you an efficient way to accept applications. Ask for as many details as you need from your applicants by customizing the template and adding or removing parts that are not relevant to you. Integrate the form with 3rd party apps such as Salesforce or Google Sheets and help your financial institution become more agile and customer-centric.

FAQ

What are change request forms in banking?

Whenever a customer needs to make a change to their bank account, a specific direct deposit authorization, or another type of financial transaction, they’ll need to fill out a change request form, where they give details about the requested updates and the reason for it.

What are some of the most common forms of e-banking?

Amongst the most common forms of e-banking, you’ll find online banking, electronic notifications, ATM, Point of Sales (POS), electronic fund transfers (wire transfers, direct deposits, etc.), credit card, debit card, etc.

What does TIN stand for on banking forms?

TIN stands for Taxpayer Identification Number, and it is an identification number issued by IRS (Internal Revenue Service) used for tax purposes.

Load more...